Tax transparency rules for crypto-asset transactions (DAC8)

DAC8, proposal for amending Directive 2011/16/EU on administrative cooperation in the field of taxation. It would be the 8th amendment of the directive, hence the DAC8 naming. Under DAC8 crypto-asset service providers (or CASPs) are required to report information about their clients' transactions to EU member states' tax authorities, including but not limited to:

- Identity information: name, address, and tax identification number (referred to as in TIN in the texts)

- Transaction details: date, value, and nature of the transaction (e.g. purchase, sale, transfer, ...)

- Type of crypto-asset involved: e.g. Bitcoin, Ether, ...

- Account information: details of the crypto-asset account or wallet

Central Bank Digital Currencies (CBDCs) would not be excluded from this reporting requirement, but possibly only account balances would need to be reported. Not the individual transactions per wallet, since CBDCs value is / should be stable by default.

Here is a great briefing by EPRS (European Parliamentary Research Service) on the proposed changes: https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2023)739310

If you are interested in the nitty-gritty details on what needs to be reported to the tax man, here is the proposed amendment😉: https://eur-lex.europa.eu/eli/dir/2023/2226/oj

Please note that here are no specific security requirements in the text, but this is yet another compliance obligation one needs to account for when operating a CASP in the EU.

As a closing note, you can clearly see that the EU is closing the nets on tax evasion via this regulation (especially when combined with the TFR or "travel rule" regulation).

CASPs are getting regulated like regular banks, and they will all need to dance to the tune of the EU regulators.

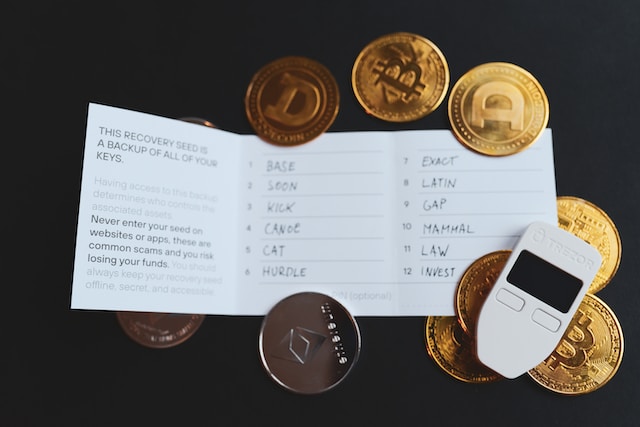

Photo by Stock Birken on Unsplash