A Critical Look at PwC’s Digital Euro Cost Study

In June 2025 I came across this study by PwC (note that it was commissioned by the European Association of Co-operative Banks (EACB), the European Banking Federation (EBF) and the European Savings and Retail Banking Group (ESBG) - so take it with a grain of salt🧂considering the interests of these organisations...):

https://www.pwc.de/de/finanzdienstleistungen/pwc-digital-euro-cost-study-2025.pdf

Key Findings

The cost estimate depends largely on the size of the banks together with other characteristics such as their structure (centralised or decentralised), with average change cost estimated at 110 million euro per bank, excluding offline, multiple accounts and merchant acquiring (i.e., the cost for the processing of payments). In line with the scope of this study, this figure represents only a part of the total costs to be covered for the introduction of the digital euro. If the results of this study are extrapolated to the entire euro area, the total change cost for banks in the euro area could amount to 18 billion euro.

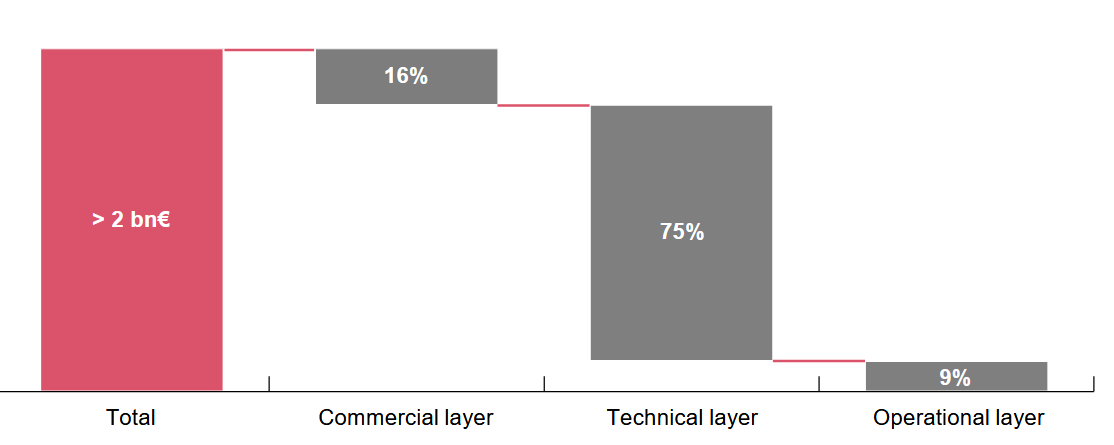

Main cost drivers relate to technical adjustments (e.g., intermediary applications, interfaces and ATM infrastructure), which account for around 75% of the estimated total costs of participating banks (> 1.5 billion euro). Additionally, the introduction of the digital euro will not only entail considerable financial resources but also significant deployment of personnel from across various areas of expertise. On average, respondents assume that almost 46% of the resources with relevant skills would be tied up per year – some banks assume even higher capacities –which would materially limit the innovative ability of the banks.

While I did not have the empirical results to back up my claim: these figures seem highly exaggerated. I get that new implementations cost money (often a lot of money - yes, I am looking at you PSD2 regulation, that enacted Open Banking in the EU). But come on, €110M is a shitload of money. Let me break this down.

PwC used a three layer model to structure the estimates for major digital euro

cost drivers:

1. Commercial layer focuses on the go-to-market approach and customer relationships;

2. Technical layer covers technology and infrastructure including (mobile) banking applications, physical card, ATMs, branch networks, POS terminals, as well as functionalities the rulebook lists as liquidity and access management;

3. Operational layer takes a closer look at core back-office processes, such as fee calculation, reporting, and payment statistics, to support the seamless integration of the digital euro.

75% of €110M = €82,5M. I understand large banks rely on ancient technology such as mainframes and need to integrate with ATM technolgy (which might even make the IBM zSeries look modern), but approx. € 80M to integrate some sort of new front-end wallet functionality in their online banking app, as well as a back-end integration? That seems far fetched - or just your corporate bureaucratic bullshit camouflaged as a research report.

/end of rant

Photo by Skyler Smith on Unsplash