CBDC architectures, the financial system, and the central bank of the future by Rainer Böhme & Raphael Auer

If you are interested in understanding what is a Central Bank Digital Currency (CBDC) and its usefulness, I suggest you consult your favourite search engine first, before getting into the nitty-gritty technical details 🔬

Here we are, a first article on Central Bank Digital Currencies! I will mainly focus on the digital euro (and for now, its pilot projects), but there is a lot of security & risk related research from other international sources, that I will cover as well.

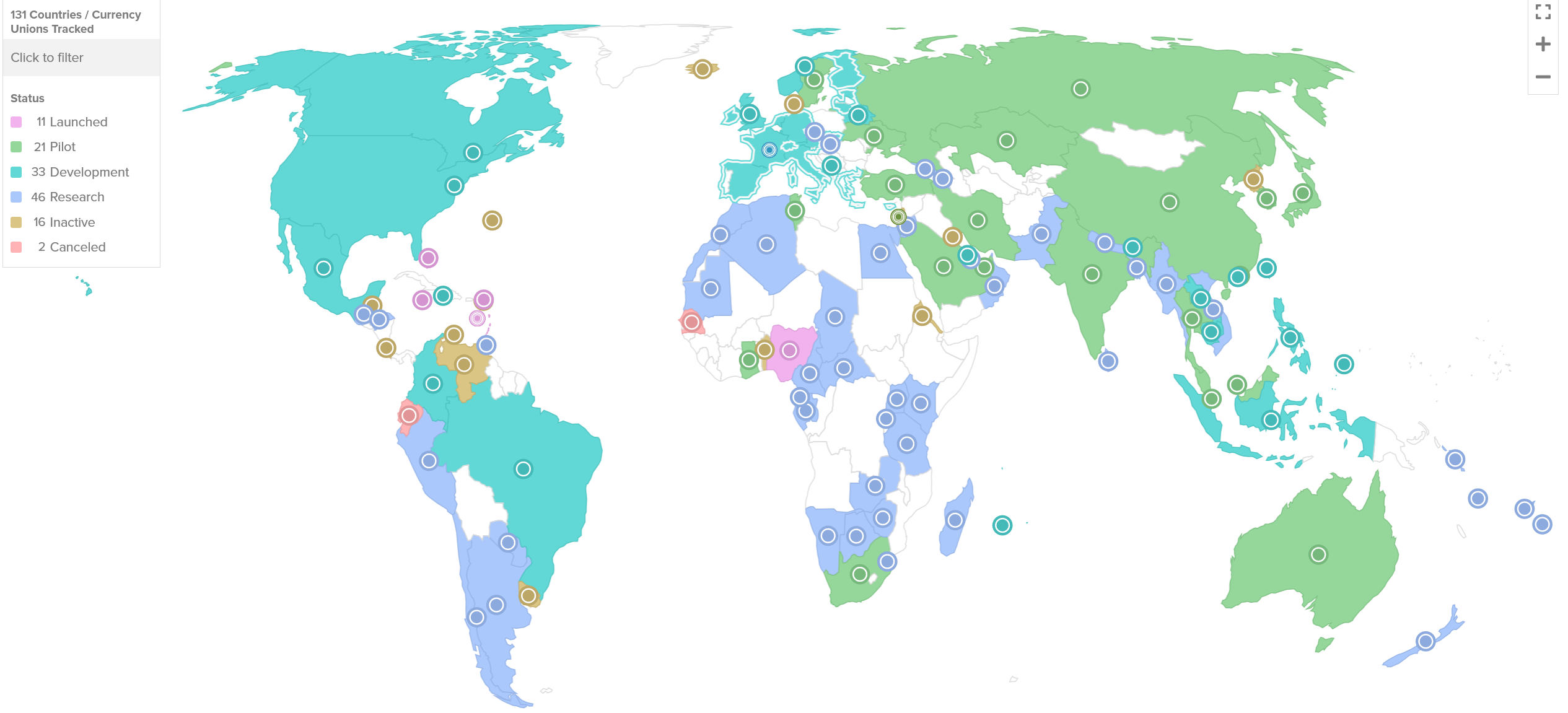

Most countries are exploring a CBDC by now. According to the Atlantic Council, 130 countries, representing 98 percent of global GDP, are exploring a CBDC . The Atlantic council has a slick website tracking CBDC projects, so make sure to have a look:

One does not simply 'launch' a CBDC

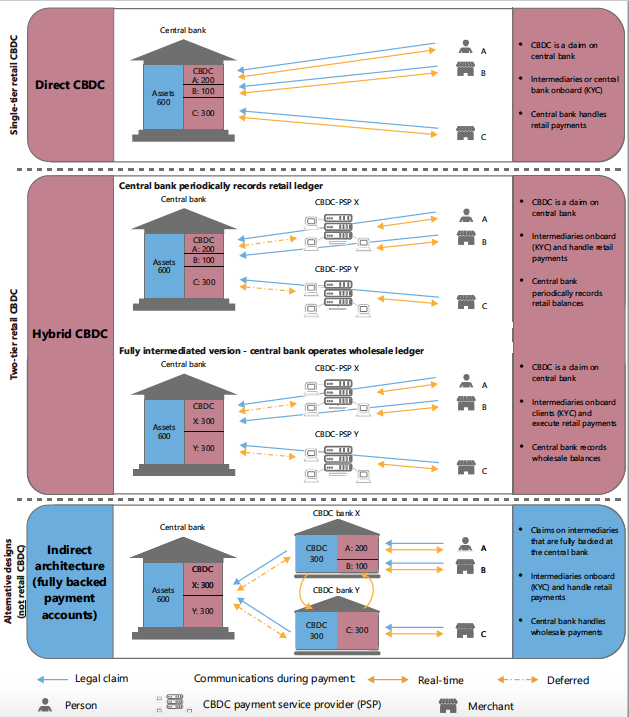

Anyway, besides countries' interest in CBDC's, one of the more interesting aspects (imho) is how exactly is (or better: will be) this implemented, and why? Enter the many different, possible CBDC architectures. (Spoiler alert: it does not necessarily need to be based on Distributed Ledger Technology)

Here is a great article by Rainer Böhme & Raphael Auer for the Centre for Economic Policy Research (CEPR), explaining different designs with their pros and cons: https://cepr.org/voxeu/columns/cbdc-architectures-financial-system-and-central-bank-future